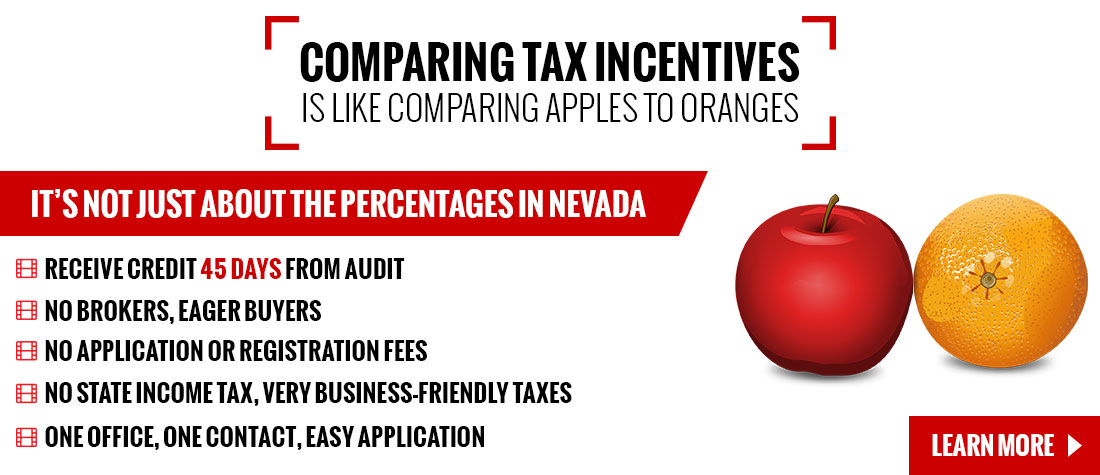

Comparing tax incentives is like comparing apples to oranges. It’s not just about the percentages in Nevada. Click here to see how we compare to other states.

Transferable Tax Credit For Film and Other Productions

Effective: July 1, 2021

Be sure to check out The NFO Podcast interview w/ Film Office Analyst, Kim Spurgeon, to learn more about how our tax incentives can benefit your production.

Incentive

Above the Line Labor – 15% Resident, 12% Non-Resident

Below the Line Labor – 15% Resident, 0% Non-Resident

Production Costs – 15%

Bonus

Bonus 1 – Below the Line NV Resident 5%

Bonus 2 – Rural County Location 5%

Incentive Details

Transferable Tax Credit

- 15% of the cumulative qualified production costs

- 15% on wages, salaries, and fringe benefits to all NV resident personnel

- 12% on wages, salaries, and fringe benefits to non-resident above the line personnel

Bonus 1

Plus 5% of the cumulative qualified production costs if greater than 50% of below the line crew are NV residents (not including extras; calculated by number of workdays worked)

Bonus 2

Plus 5% of the cumulative qualified production costs if greater than 50% of the filming days occurred in a NV county in which in each of the two years immediately preceding the date of application, qualified productions incurred less than $10 million of direct expenditures

Carry Forward

Credit expires four years after tax credits issued

Transfer Rules

Must notify State prior to any transfer and before expiration date

Project Criteria

- Qualified production costs in NV must be greater than $500,000

- At least 60% of the production budget, including pre-production, production, and post-production, must be incurred in Nevada as qualified direct production expenditures. However, if all post-production will be completed outside of Nevada, then post-production expenditures can be withheld from the 60% calculation

What Qualifies

Pre-production, production, and post-production expenditures, including, but not limited to, compensation and wages to residents and non-residents and purchases and rentals of tangible personal property or services from a NV business

Compensation Caps

- Compensation to all NV resident producers must be 10% or less of the total qualified expenditures

- Compensation to all non-NV producers must be 5% or less of the total qualified expenditures

- Per individual/loan-out corporation caps at $750,000

Project Caps

$6,000,000 per production

Program Funding Cap

$10,000,000 in program funding; contact the office for current availability

Company Registration

Must register with the Nevada Film Office

Loan-Out Withholding

None

Loan-Out Registration

Not required

CPA Audit

Required from an approved CPA by the Nevada Film Office

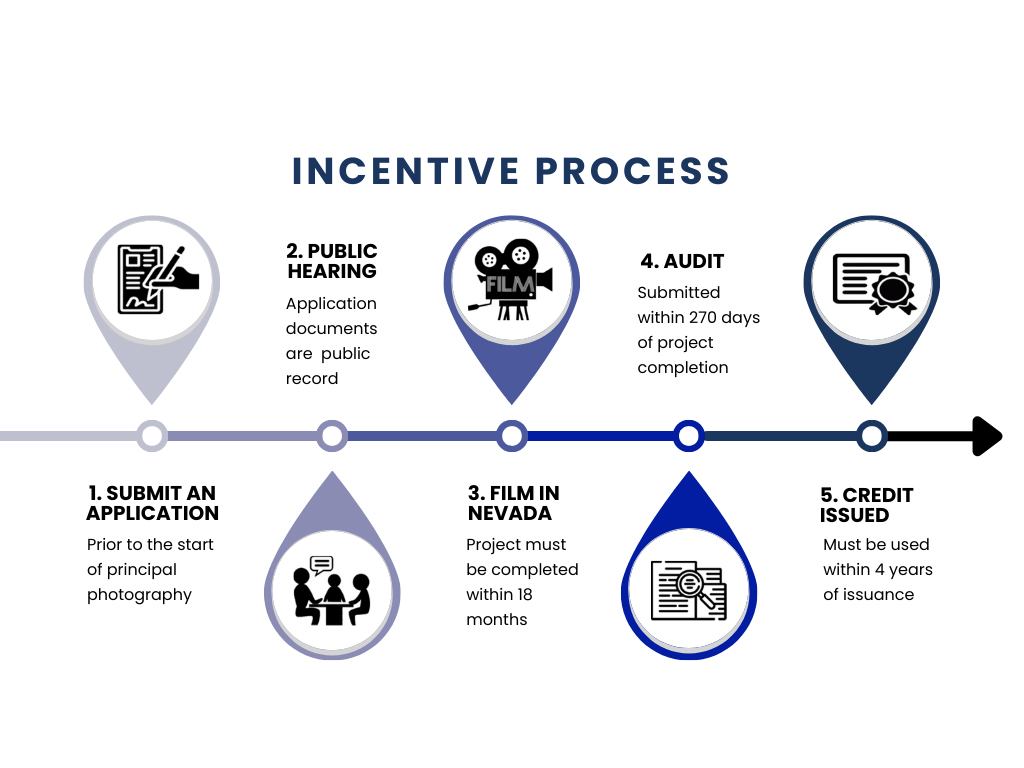

Getting Started

- submit completed application

- proof that the project is in the economic interest of NV

- proof of project financing in place

- script, storyboard or synopsis

- names of producer, director, proposed cast, estimated timeline to complete the qualified production

- summary budget (including costs incurred outside of NV)

- insurance certificate for at least $1 million in general liability

- proof of Worker’s Compensation Insurance

- proof of all required business licenses for each location

- commencement of principal photography must begin no later than 90 days after the application is approved

Claiming Incentive

- All accountings and other required documentation must be submitted not later than 270 days after completion of the qualified production

- production must be completed within 18 months after the commencement of principal photography

- CPA audit required

- producer must elect type of qualified taxes to which the credit will be applied

Crew Base

Nevada Production Directory available online

The following files require Adobe Reader.

Please click here to download Adobe Reader.

Connect With Us

Proud Members of: